All this is a fancy way of saying that I am standing by my post of June 10th as the economic data revisions going back to the 2007-2009 recessions indicate clearly you can’t trust the early official economic data or Mike Hoss’ pronunciation of same while filling in for the Toolman. 😉

Those economic data revisions really bothered me which is what moved me to write the post that contained the above quote to begin with. While ordinary Americans have struggled since 2007 to keep their heads above water with sky-high gasoline prices and the economic collapse of 2008, our elected leaders have consistently tried to paint a brighter picture of the economy pointing to certain official statistics to make their point. The problem is the stats are subject to revision and it appears the data revisions are telling the real story and it isn’t a good one. Luckily for all of us I don’t have to go into great detail as the good folks over at The Economic Populist have done all the heavy lifting in a piece that is well worth reading. Here is a snippet:

The Q2 2011 GDP report showed draconian revisions. Q1 2011 GDP was revised downward from 1.9% to 0.4%.

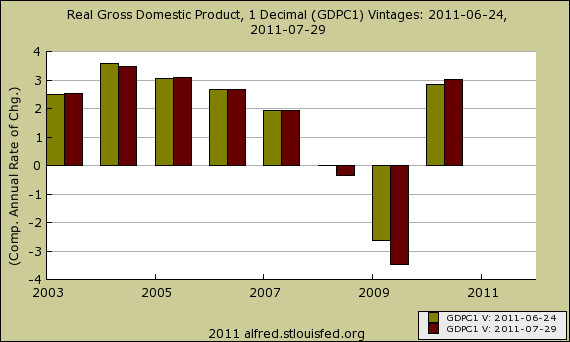

On an annual basis, 2008 GDP was revised from 0% to -0.3%. 2009 shows just how bad the economy became with a new annual -3.5% GDP, revised from -2.6%. 2010 was revised upward by just 0.1% to 3.0% for the year. Below are annual GDP revisions. This graph was generated from ALFRED, which allows you to compare historical economic data. The dark red bars are the revised numbers, compared against the previous GDP, in green.

The worse revisions are in Q4 2008 and Q1 2009. Instead of a -6.8% quarterly annualized change for Q4 2008, it was –8.9%. Q1 2009 was revised to –6.7%, from -4.9%. Below are the quarterly GDP revisions. The BEA reports quarterly GDP as annualized.

The bottom line? The economy is fugly.

Revisions normally go back 3 years and are done in July, but there were additional revisions that went back all the way to 2003. The summary of where these revisions came from is here. Bottom line, real GDP, or in chained 2005 dollars, is less than before the recession. In other words, our economy has shrunk and not recovered.

The data and pundits that I follow all indicate we have some rough economic water dead ahead as the Keynesianesque stimulus programs of 2009/2010 work their way out of the economic cycle. The silver lining is that we likely will have a nice buy opportunity on the back-end of the carnage. Strap yourselves in folks.

sop

Timberrrrrr.

sop

Sop,I get the impression you are totally out of the market and waiting for the trees to fall. Of course the inside traders have been out for a while and what's left are the pensions which usually ride out the storms.

I'm convinced that the feds are going to intentionally force low interest rates on savings and CD's down our throats for the unforeseeable future to keep interest rates on the national debt artificially low so I'm humbly investing in tax free bonds at a whopping 4.5 % for the next 10 -15 years. Whooptie-do but I think we are going to have higher tax rates coming down in 3-4 years be it by the democrats or republicans.

I'm out with everything including my pension. That said it is true big pension funds like a typical state retirement system have a much harder time turning on a dime but they too still actively manage their risks, some better than others.

Obama has caught lots of hell for his handling of the economy, much of it deserved but we're in a bad spot that limits the options of a politician looking to self perpetuate themselves via re-election. That bad spot is:

1. Raising taxes and cutting spending individually and/or in combination will place a drag on the economy that very well could push us back into recession.

2. Interest rates can realistically go no lower to help stimulate consumer demand, which is weak is to begin with. The flip side is the low rates also mean rates on CD's and bonds are also low.

3. While the ratings agencies have affirmed the country's AAA credit rating all have also issued a negative outlook which means a future downgrade is more likely than not. Moody's was the latest shoe to drop that way just yesterday as the realization has set in that the spending cuts in the debt ceiling compromise are illusory over the short term as the can was kicked down the road yet again. For me the worst part is all the drama in DC conveyed an image that our political system has become dysfunctional as political compromise has become a dirty word.

For those of us in the Slabbed Nation that are old enough to remember the early 1980s and 20+ percent interest rates it appears that is exactly where we are headed ultimately IMHO.

Worth remembering is the stock market overall is a good indicator of economic health. It runs in mega trends (secular bull and bear markets). Within those mega trends there are cyclical short term trends (cyclical bull and bear markets). The last secular bull market ran from 1982 to the year 2000. The preceding secular bear market ran 16 years. My point here is that we are into year 12 of the current secular bear and since 1906 the three secular bear markets ran a minimum of 16 years and one 20 (the great depression). And the cyclical bears within the secular bear megatrend tend to be brutal. It gives me pause especially when you consider that capulation has not yet occured in this secular bear megatrend. (A recent blog post on secular market trends can be found here.)

Finally tax free bonds are not free from credit risk as the bankruptcy of Orange County California illistrated and it is especially topical in these hard economic times in the states hit harder by the real estate bubble. My safe haven for now is in Ginnies but unless something is done that too will cease to be an option longer term.

sop